It doesn’t matter how much you earn, what truly matters is what you can do with it. This is where the Local Purchasing Power Index (LPPI) becomes essential. The Local Purchasing Power Index (LPPI) provides a clear measure of this, comparing the average income to the cost of living within a nation. A higher LPPI indicates that residents can purchase more goods and services with their earnings.

This index is a critical tool for assessing the economic health of developed countries. It not only reflects the strength of wages and the affordability of goods but also offers valuable insights into where individuals, businesses, and investors might thrive and live comfortably.

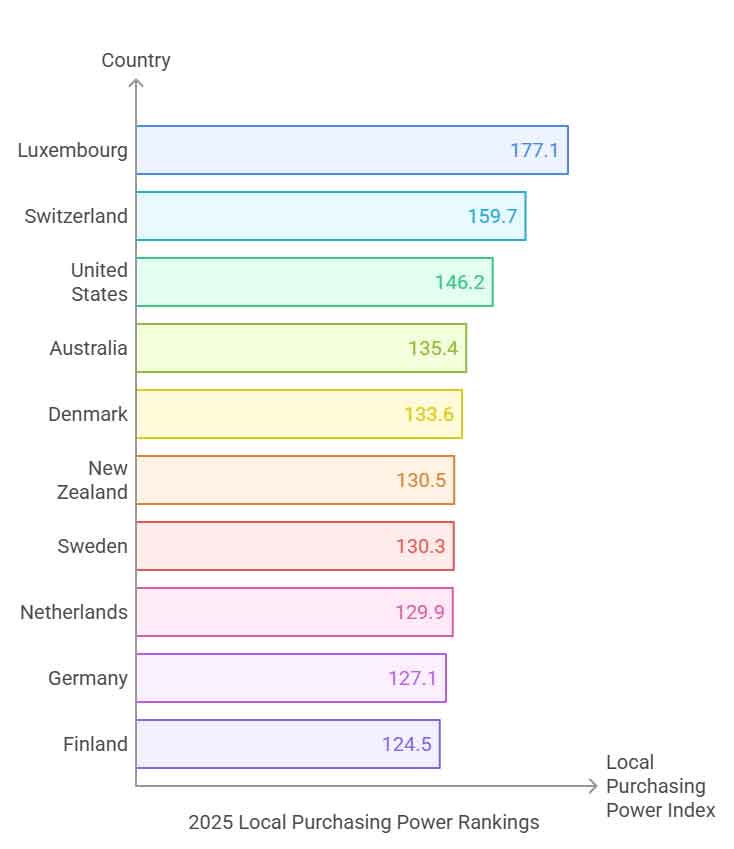

In this article, we present the 2025 rankings of developed countries based on their LPPI scores according to Numbeo, showcasing the nations where economic conditions enable greater financial freedom.

I. Understanding the Local Purchasing Power Index (LPPI)

1. What is the Local Purchasing Power Index?

The Local Purchasing Power Index (LPPI) measures how much a person can buy with their income in a specific country, considering the cost of living. It provides a clear view of how wages compare to the prices of goods and services. A higher LPPI indicates that residents can afford more with their earnings, while a lower score suggests that the cost of living might outweigh income levels.

2. How is the LPPI Calculated?

The LPPI is determined by analyzing two main factors:

- Income Levels: This includes the average wages or earnings in a country.

- Cost of Living: This covers the prices of everyday goods and services such as food, housing, transportation, and utilities.

These two elements are compared and indexed against a baseline, often set to 100 for a specific country like the United States. A country with a score above 100 indicates higher purchasing power, while scores below 100 reflect lower purchasing power.

3. Why is the LPPI Important?

The LPPI is an essential tool for understanding economic well-being and affordability in different countries. Here’s why it matters:

- Economic Comparison: It allows for meaningful comparisons between countries, highlighting where incomes align well with living costs.

- Living Standards: It reflects the overall quality of life, as higher purchasing power often correlates with better access to goods and services.

- Global Insights: It provides a snapshot of which economies offer stronger financial opportunities for residents.

4. How Does the LPPI Affect You?

Whether you’re evaluating a country to live in, planning to invest, or comparing global economies, the LPPI offers practical insights. It helps you understand where money can go further, which regions provide better affordability, and which economies are thriving.

Also Read: The 10 Best vs. Worst Job Markets in First World Countries in 2025

II. The 2025 Rankings: Developed Countries by Local Purchasing Power

1. Luxembourg – 177.1

Luxembourg ranks first with an LPPI of 177.1, making it the leader in purchasing power among developed countries. Despite its small size, Luxembourg’s robust financial sector, particularly in banking and investment, contributes to its high salaries. While the cost of living is relatively high, the combination of substantial wages and government support for housing, healthcare, and childcare allows residents to enjoy unmatched economic flexibility. The country’s strong economic performance ensures that even with significant expenses, its citizens can purchase more with their earnings compared to other nations.

2. Switzerland – 159.7

Switzerland takes second place with an LPPI of 159.7, emphasizing its balance of high incomes and strong economic foundations. The Swiss franc is one of the world’s most stable currencies, contributing to the purchasing power of its residents. Switzerland is also known for its high cost of living, especially in urban areas. However, wages in industries such as pharmaceuticals, finance, and technology are among the highest globally, allowing citizens to offset living expenses and maintain significant purchasing power.

3. United States – 146.2

The United States ranks third with an LPPI of 146.2, reflecting a varied economic landscape where wages and costs differ across states. The country’s vast economy provides opportunities in high-paying sectors such as technology, finance, and healthcare. While the cost of living is higher in urban centers like New York and San Francisco, many areas offer a balance of affordable housing and competitive salaries. This regional variation ensures that, overall, Americans enjoy strong purchasing power, with high levels of disposable income in many regions.

4. Australia – 135.4

Australia places fourth with an LPPI of 135.4, showcasing its high-income economy supported by industries such as mining, education, and healthcare. While the cost of living in Australia can be significant, particularly in cities like Sydney and Melbourne, the country’s wage levels compensate effectively. Australians benefit from a relatively affordable healthcare system and public services, which further enhance their financial stability and purchasing power. The country’s focus on work-life balance and quality of life also plays a role in maintaining its strong economic standing.

5. Denmark – 133.6

Denmark ranks fifth with an LPPI of 133.6, reflecting its efficient economic policies and focus on equality. Although Denmark has a high cost of living, the country’s strong social welfare system ensures access to subsidized healthcare, education, and housing. High wages in industries like renewable energy, pharmaceuticals, and design support residents in maintaining purchasing power. Additionally, Denmark’s emphasis on sustainability and economic inclusivity contributes to its position as a leader in ensuring financial security for its citizens.

6. New Zealand – 130.5

New Zealand ranks highly for purchasing power due to its relatively balanced cost of living and income levels. While the country’s currency, the New Zealand Dollar, is not as strong globally, it holds substantial local value. Housing costs in major cities like Auckland are significant, but rural areas offer more affordable living. New Zealand’s economic structure is heavily reliant on exports, such as agriculture and dairy, providing robust earnings for its workforce. The high purchasing power is also supported by a low unemployment rate and a focus on lifestyle balance, making essentials and discretionary spending more accessible.

7. Sweden – 130.3

Sweden demonstrates a unique economic model where high taxes fund comprehensive welfare systems. This ensures residents benefit from free or low-cost healthcare, education, and public services, reducing out-of-pocket expenses. Despite higher-than-average costs for housing and consumer goods, wages in Sweden are competitive, especially in industries like renewable energy, technology, and manufacturing. Sweden’s purchasing power is enhanced by its efficient urban planning and emphasis on social equality, allowing citizens to achieve financial comfort without excessive burdens.

8. Netherlands – 129.9

The Netherlands stands out for its strategic location as a European trade and logistics hub, which boosts income levels in sectors like finance, technology, and international trade. While the cost of living is notably high, particularly in Amsterdam, strong worker protections and relatively high wages contribute to maintaining purchasing power. The Dutch government’s policies on affordable healthcare and public transportation further alleviate financial pressures for residents. The balance of a thriving economy and effective public services ensures that citizens can maximize their earnings for both essentials and leisure.

9. Germany – 127.1

Germany’s purchasing power reflects its status as Europe’s largest economy and a global leader in innovation. The country offers high wages in engineering, manufacturing, and technology, which are complemented by lower living costs in many non-metropolitan areas. While cities like Munich and Frankfurt are more expensive, Germany’s excellent public infrastructure reduces transportation and utility expenses. Additionally, strong labor laws and relatively affordable education ensure citizens retain more of their disposable income, enhancing overall economic stability and purchasing power.

10. Finland – 124.5

Finland’s ranking is bolstered by its focus on equitable economic policies and innovation-driven industries. While living costs in urban areas like Helsinki are high, they are balanced by generous social benefits, including free healthcare and education. Finland’s purchasing power is also supported by competitive salaries in technology, forestry, and clean energy. The country’s emphasis on sustainability and efficient resource management reduces costs in key areas like energy, further increasing the disposable income of its residents. Finland’s model ensures financial stability and economic confidence for its population.

Also Read: 4 Popular Effective Budgeting Strategies (Explained)

11. Iceland – 123.5

Iceland’s high purchasing power is shaped by its unique economy, centered around sustainable energy, fishing, and tourism. The country benefits from low unemployment and high wages, particularly in sectors such as renewable energy and tech innovation. However, Iceland’s isolated geography results in elevated costs for imported goods, which is offset by strong domestic production and policies that prioritize citizens’ well-being. Free healthcare and education further increase disposable income, providing Icelanders with significant purchasing power despite their country’s relatively small population.

12. United Kingdom – 119.9

The United Kingdom combines a robust financial sector with diverse industries to sustain strong purchasing power. While the cost of living varies significantly across the country, with London being one of the most expensive cities globally, other regions offer affordable housing and living expenses. Competitive salaries in finance, technology, and healthcare help offset higher costs in urban areas. Additionally, the UK’s comprehensive public healthcare system ensures that citizens save on medical expenses, enabling them to allocate more funds toward other necessities or discretionary spending.

13. Japan – 119.8

Japan achieves high purchasing power through its efficient economy, driven by advanced technology, manufacturing, and export-oriented industries. Despite limited natural resources, Japan has minimized energy costs through innovation. Urban living in cities like Tokyo can be expensive due to housing prices, but efficient public transport and accessible healthcare reduce overall financial strain. Strong income levels, particularly in technology and engineering, contribute to Japan’s purchasing power, allowing citizens to maintain a high standard of living in a densely populated country.

14. Norway – 119.5

Norway’s purchasing power stems from its abundant natural resources, particularly oil and gas, which have funded a robust social welfare system. High wages across various sectors, from energy to healthcare, empower citizens to afford Norway’s higher cost of living. The government’s emphasis on equal wealth distribution ensures that purchasing power is not limited to urban centers but is felt nationwide. Free education and healthcare alleviate financial burdens, while investments in sustainable practices and green energy provide long-term economic stability.

15. Belgium – 116.1

Belgium benefits from its central location in Europe, acting as a hub for international trade, politics, and business. While the cost of living is moderate to high, wages in key sectors like logistics, finance, and public administration are competitive. Belgium’s well-developed public transportation network and affordable healthcare system contribute to its purchasing power by reducing essential costs. Additionally, the presence of multinational organizations and a diverse job market ensures financial stability for its residents, further supporting purchasing power.

16. France – 110

France combines a strong industrial base with a well-established social welfare system to maintain high purchasing power. While urban centers like Paris are known for high costs, other regions provide more affordable living. Salaries in industries like fashion, technology, and agriculture allow citizens to manage expenses effectively. Government-subsidized healthcare, childcare, and education reduce out-of-pocket costs, freeing up income for other uses. France’s blend of innovation and tradition creates a resilient economic environment that supports its population’s purchasing power.

17. Canada – 109.1

Canada’s purchasing power is bolstered by its vast natural resources and diversified economy, with key sectors including energy, technology, and finance. The cost of living is moderate, but wages, especially in urban centers like Toronto and Vancouver, help offset housing expenses. Canada’s public healthcare system and subsidized education provide significant savings, increasing disposable income. The country’s focus on immigration and workforce development also strengthens its economy, ensuring financial security and purchasing power for both residents and newcomers.

18. Ireland – 108.9

Ireland has become a hub for technology and finance, attracting multinational companies with favorable tax policies and a highly educated workforce. High salaries in sectors such as tech and pharmaceuticals contribute significantly to the local purchasing power. While housing costs have risen sharply in urban centers like Dublin, government measures to increase housing supply aim to address affordability. The absence of certain taxes on essential goods also bolsters disposable income, ensuring that residents maintain strong purchasing power relative to living costs.

19. Austria – 107.1

Austria’s strong purchasing power is rooted in its diversified economy, which includes tourism, manufacturing, and a growing green energy sector. High wages and stable employment rates provide financial security for residents. The cost of living is balanced by affordable public services, such as healthcare and education, which reduce household expenses. Austria’s robust public transportation network further minimizes commuting costs, particularly in urban areas. Additionally, the country’s cultural emphasis on quality of life supports sustainable spending habits, enhancing economic stability.

20. South Korea – 105

South Korea’s high purchasing power reflects its status as a global leader in technology and innovation. While urban living, particularly in Seoul, comes with higher housing costs, competitive salaries in industries such as electronics, entertainment, and automotive manufacturing offset these expenses. The country’s extensive public transit system and affordable healthcare reduce essential costs for residents. South Korea’s strong export-driven economy ensures job stability, enabling citizens to allocate their income effectively toward both necessities and discretionary spending.

21. Spain – 98.1

Spain’s purchasing power is shaped by its dynamic economy, which heavily relies on tourism, agriculture, and services. Although wages are lower compared to some Western European countries, the cost of living in Spain is significantly more affordable, particularly outside major cities like Madrid and Barcelona. Affordable housing and lower utility costs enable residents to stretch their income further. Spain’s public healthcare system and subsidized education reduce financial burdens, allowing households to maintain purchasing power despite modest salaries.

22. Singapore – 93.8

Singapore’s high purchasing power stems from its position as a global financial and trade hub. While the city-state has one of the highest costs of living in the world, its residents benefit from competitive salaries, especially in sectors such as finance, technology, and logistics. Public housing programs and efficient public services, including healthcare and transportation, mitigate some of the living expenses. Singapore’s focus on upskilling its workforce and attracting global talent ensures continued economic growth and financial stability for its population.

23. Poland – 91.4

Poland has experienced significant economic growth in recent years, with an expanding tech sector and a strong manufacturing base. Although wages are lower than in many Western European countries, so is the cost of living, making essentials and housing more affordable. This affordability allows residents to maintain a relatively strong purchasing power. Poland’s public healthcare system and lower taxation on basic goods contribute to disposable income, enabling households to manage their expenses effectively despite moderate salaries.

24. Italy – 85.1

Italy’s purchasing power reflects a balance between its strong cultural and industrial economies. Wages in sectors such as design, fashion, and agriculture are complemented by a lower cost of living in rural areas compared to cities like Milan or Rome. However, challenges such as high unemployment rates, particularly among younger populations, affect economic stability. Despite this, Italy’s public healthcare system and affordable housing options in many regions help residents maximize their purchasing power relative to their income.

25. Estonia – 84.2

Estonia has achieved rapid economic development in recent decades, emerging as a leader in digital innovation and e-governance. However, the Local Purchasing Power Index (LPPI) of 84.2 reflects the country’s challenges in aligning wages with rising living costs. While the cost of living in Estonia is relatively low compared to Western Europe, average salaries have not kept pace with inflation and housing demand, particularly in Tallinn. Additionally, the reliance on imported goods increases costs for consumers, further impacting local purchasing power.

26. Lithuania – 79.8

Lithuania’s LPPI score of 79.8 highlights the limitations in wage growth relative to living expenses. While the country has seen significant improvements in economic stability since joining the European Union, average incomes remain below the EU average. The cost of housing and utilities has risen steadily, particularly in urban centers like Vilnius, limiting disposable income. Efforts to attract foreign investment and develop higher-paying industries aim to address these disparities, but economic inequality persists, affecting the population’s purchasing power.

27. Latvia – 75.8

Latvia’s LPPI of 75.8 underscores the challenges faced by its workforce in balancing wages and living costs. While the country benefits from a strategic location and a growing economy, salaries in key industries remain low. Urbanization has driven up housing prices in cities like Riga, further straining household budgets. Though Latvia offers affordable healthcare and public transportation, higher costs for imported goods and services reduce disposable income, making it difficult for residents to enjoy the same level of purchasing power as in neighboring countries.

28. Malta – 75.3

Malta’s LPPI score of 75.3 reflects the island nation’s unique economic challenges. While the country boasts a strong tourism sector and a thriving gaming industry, these industries often provide seasonal or moderately paying jobs. Housing shortages and high rental costs significantly impact disposable income, especially for those living in popular urban areas. The reliance on imported goods and limited availability of affordable public services also contribute to the relatively low purchasing power among residents.

29. Greece – 59.9

Greece’s LPPI of 59.9 is one of the lowest among European countries, reflecting the long-term impact of its economic crisis. Despite recovery efforts, wages in many sectors remain stagnant, while living costs, particularly for housing and utilities, have risen. High unemployment rates and a heavy tax burden exacerbate the strain on household incomes. While Greece’s affordability in rural areas provides some relief, urban residents often struggle to maintain a balanced standard of living, highlighting the disparity in purchasing power across the country.

30. Portugal – 59.7

Portugal’s LPPI of 59.7 illustrates the economic struggles faced by many of its citizens. Although the cost of living in Portugal is relatively low compared to other Western European countries, average wages are also among the lowest in the region. Rising housing costs, driven by foreign investment in real estate, have further diminished local purchasing power. Additionally, limited access to high-paying jobs in industries such as technology and finance means that many workers rely on low to moderate incomes, making it challenging to meet rising expenses.

Understanding the Local Purchasing Power Index (LPPI) sheds light on the true value of income across nations, going beyond surface-level economic comparisons. It reveals the interplay between wages, living costs, and economic structures, offering a deeper perspective on financial well-being. Whether you are considering relocation, investment, or global market trends, LPPI serves as a critical metric for making informed decisions and understanding how different countries balance income and affordability in shaping their residents’ lifestyles.